What drives Emerging Europe equities in 2026?

Strong earnings outlook

One of the material drivers of Emerging Europe regional equity returns over the coming years is the favourable earnings outlook, underpinned by an improving trend in earnings revisions in recent months. Corporate earnings growth potential in Emerging Europe remains strong and is well supported by the positive macroeconomic backdrop. The expected 3-year forward-looking earnings CAGR for the Emerging Europe regional benchmark stands at approximately 17.2%, exceeding the 13.5% projected for the MSCI ACWI and 7.8% for the Euro Stoxx 50. Should this growth materialise, it would represent a powerful and sustained driver of equity returns in Emerging Europe.

Monetary easing and strong consumer

The macro outlook for Emerging Europe in 2026 remains constructive, supported by a combination of gradual cyclical recovery, easing financial conditions, and a pick-up in investment activity. Regional GDP growth is expected to approach 3%, led by Poland with expansion of around 3.5%, alongside solid contributions from the rest of the region. The macro backdrop should benefit from further monetary easing, with rate cuts expected in Poland, Hungary, Romania and Turkey, supporting both household consumption and corporate investment. Growth acceleration increasingly hinges on a recovery in investment activity. Poland is expected to lead, with investment growth of around 12% yoy, followed by Greece at approximately 8%, while consumer spending is projected to remain resilient across most markets.

Consumer sentiment, in particular, stands out as a relative bright spot compared with the Eurozone and the US, with the exception of Romania, reinforcing expectations of a cyclical recovery. EU funding remains a key structural support for investment, with remaining RRF resources scheduled to be drawn in 2026. At the same time, Germany’s recently announced fiscal stimulus is expected to provide positive spillovers to the region through trade and investment channels.

Poland & Greece

In Poland economic growth accelerated in 2025 and is expected to remain around 3.5% in 2026, supported by rising investment, easing inflation and still-solid household consumption – a near-Goldilocks macro setup. Inflation could surprise on the downside, potentially falling below 2.5% in 2026, which would support real wage growth and allow for more than two 25bps rate cuts.

Greece’s economy is also expected to maintain solid growth above 2% in 2026, driven by resilient consumption and investment supported by the EU funds. The services sector, including IT and tourism, remains a key growth engine. Wages are projected to rise by around 4% yoy, underpinned by increases in the minimum wage, reductions in social security contributions, and income tax reforms. Despite these fiscal measures, strong nominal GDP growth and continued budget surpluses are expected to keep the public debt ratio on a downward trajectory, with debt-to-GDP projected to fall below 140% by 2027.

Besides favourable macro backdrop, corporate earnings outlook and valuations in both countries are appealing. Although Polish WIG Index has re-rated back close to 10-year historical average level of 12.1x 1YR FWD P/E, strong expected earnings CAGR of 17.8% for the next three year should provide attractive return potential. Greek ATHEX Index trades at 10.6x 1YR FWD P/E, 17% discount to 10-year historical average, with expected 3-year earnings CAGR of 11.7%.

Avaron Emerging Europe Fund holds 31% and 21% of its portfolio in Poland and Greece, respectively.

Turkey

During 2025, we re-entered Turkey after being on the sidelines for nearly two years and currently Avaron Emerging Europe Fund holds 12.6% weight. The decision was driven by a clear regime shift in macroeconomic policy following the 2023 elections and the resulting improvement in the macro outlook. Central bank credibility has been restored through a return to orthodox monetary policy, a renewed focus on price stability, and materially tighter financial conditions, which helped inflation fall to around 30% in 2025 from a peak above 70% in mid-2024. We had deliberately stayed out of the market due to the intentional economic slowdown, the introduction of inflation accounting, and the associated earnings compression, particularly among non-financial companies. That adjustment phase has largely run its course. With inflation continuing to ease, monetary policy has entered a gradual easing cycle, although progress toward the central bank’s 16% end-2026 inflation target remains ongoing. Against this backdrop, the outlook for corporate earnings is improving meaningfully. Banks are positioned for a near-term rebound in profitability as deposit costs normalise, while consumer-oriented and export-driven companies should benefit from recovering domestic demand and currency-linked revenues. In addition, valuations remain highly attractive. The BIST 100 index trades at around 4.1x 1YR FWD P/E, representing a 54% discount to its 10-year historical average, while the implied 3-year earnings CAGR stands at a robust 78% in nominal terms.

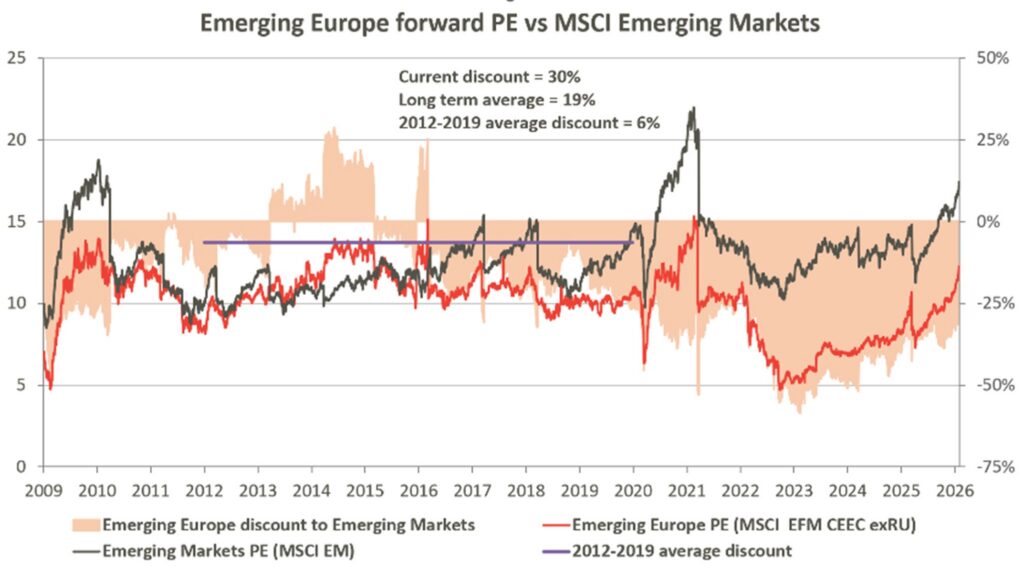

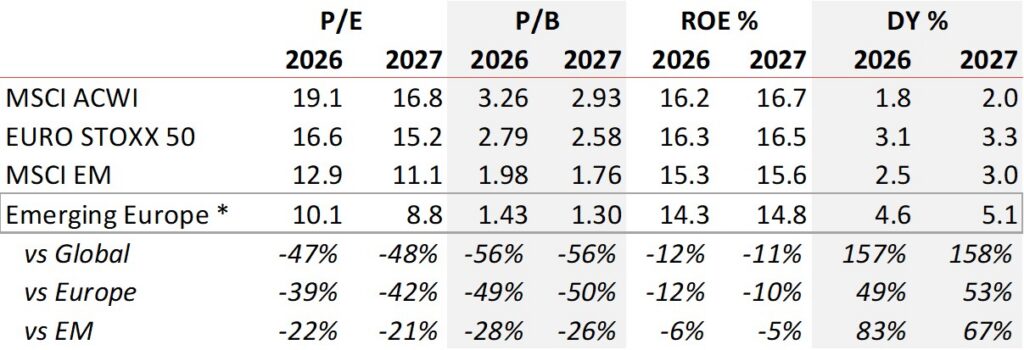

Emerging Europe still trades at discount

Despite exceptionally strong performance and further re-rating in 2025, Emerging Europe equity market continues to trade at a meaningful discount to Europe, global emerging markets, and the MSCI ACWI. The current discount to Emerging Markets stands at approximately 30%, compared with a long-term average of around 20%. Historically, this discount has been considerably narrower, averaging roughly 6% during the 2012–2020 period. In our view, a fair discount for Emerging Europe relative to Emerging Markets should be at around 10%, primarily reflecting lower liquidity. This would imply 15% re-rating potential from current levels and correspond to a valuation of 11.5x on 1YR FWD P/E basis.

* MSCI EFM EUROPE + CIS (E+C) ex Russia index

One of the key prerequisites for this re-rating potential to materialise is a resolution of the Russia–Ukraine war, which, when it occurs, would act as a powerful catalyst for further narrowing of the valuation gap. Recent increase in high-level engagement have shifted market perceptions toward a more plausible path to de-escalation or at least a durable ceasefire. Even without a comprehensive peace agreement, any credible framework that reduces tail risks, clarifies the security outlook, and stabilises regional trade and capital flows would likely be sufficient to trigger a further reassessment of risk premia. In such a scenario, investors who have been structurally avoiding Emerging Europe on geopolitical grounds are likely to return, initially through broad regional exposure and subsequently through more selective positioning, accelerating valuation normalisation across the asset class.